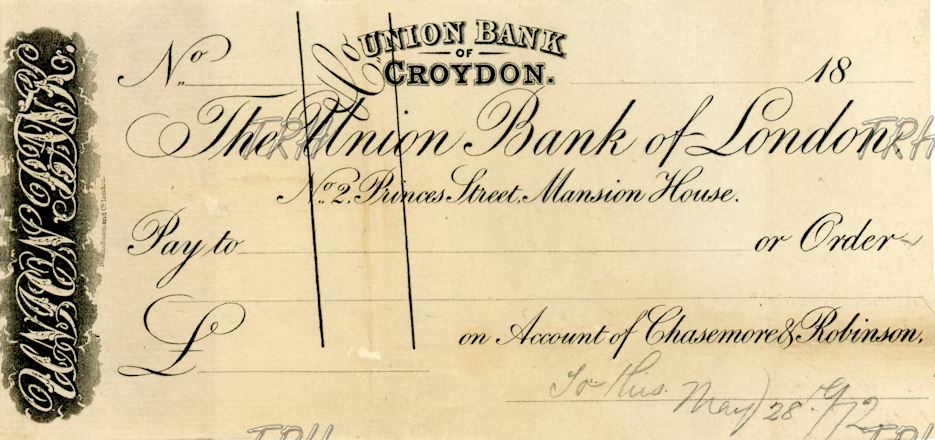

Cheque issued by Union Bank of Croydon

| From its beginning the bank treated its depositors generously; on current accounts which maintained a minimum balance of £10, 2½% interest was

allowed, and deposit accounts withdrawable at six months notice - 5%. Interest on deposit accounts was at this time something not previously known. This was naturally popular

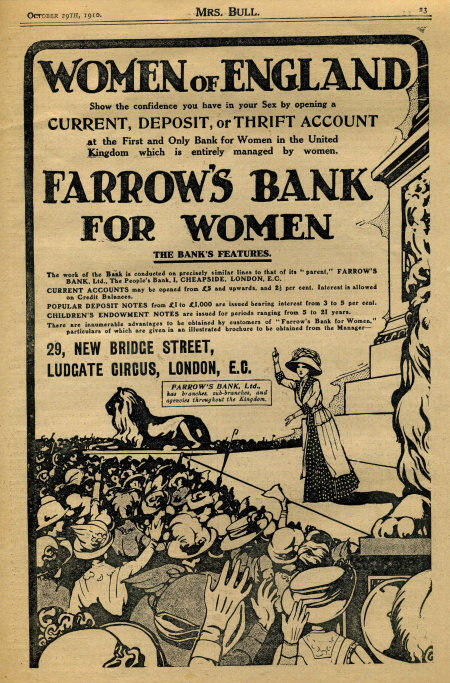

and branches soon spread over the country. For a while the bank had three branches in Croydon. In 1909 the bank was advertising branches in every county in the country. There was even a special branch in Knightsbridge 'managed by women for women'. After such a promising start, things started to go very wrong. Due to the consequences of some unsound investments, in December 1920 the bank suspended payment. Farrow was arrested a few days later, charged with falsification of accounts and sentenced to four years penal servitude. Creditors received 5s 3d (26p) in the pound. Thousands of ordinary people found that they had lost every penny they had. |  |